Financial Stability Report. December 2025

The financial system is stable and resilient to shocks.

The banking system has a large capital surplus over the regulatory requirements, mainly created by net earnings, a considerable portion of which for years has been allocated to own funds. Consequently, banks maintain adequate capacity to absorb losses and provide financial services even in pessimistic stress test scenarios.

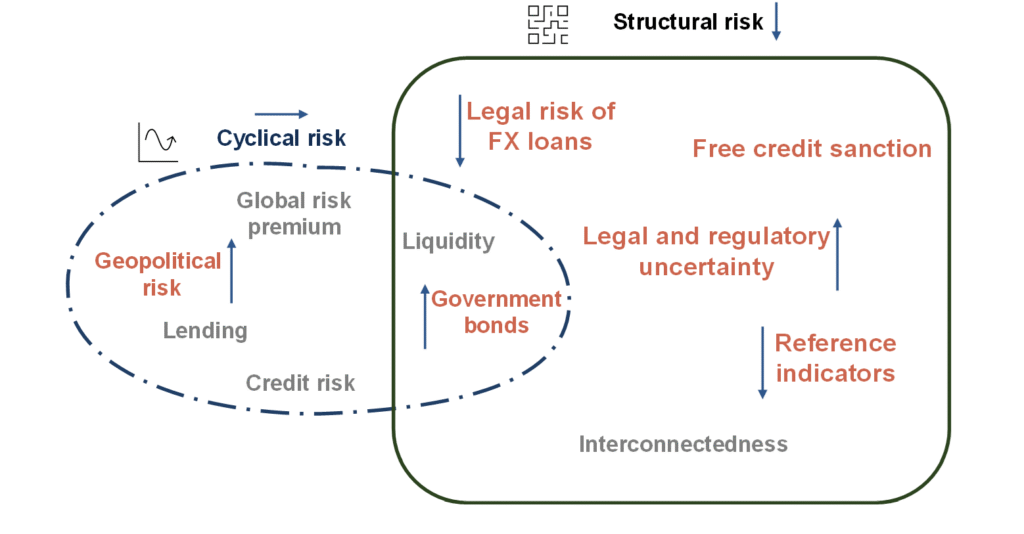

The key challenges to financial stability have not changed much since the previous edition of the Report and are mainly related to uncertainty of the legal environment, which manifests itself in two dimensions. One relates to the cost of legal risk in connection with the interpretation of consumer protection legislation in the case of zloty-denominated loans. The other arises from the limited predictability of national regulations, which makes it difficult to plan activities in the long term.

The expected scale of provisions which banks will have to establish for the legal risk of FX housing loans has decreased considerably. At this stage, this risk can be regarded as considerably reduced.

Given the large share of Treasury bonds in the balance sheets of banks, the increase in public debt and the borrowing needs of the State in the coming years may pose a challenge. This might increase the risk of a decline in bond valuations amid high geopolitical uncertainty and a potential increase in risk aversion in the financial markets.

NBP is of the opinion that the implementation of the following recommendations would be conducive to the maintenance of financial stability:

• a reduction in uncertainty of the legal and regulatory environment in which the financial system functions;

• ensuring proportionality in consumer protection on the financial market;

• a continued commitment of the financial stakeholders to complete the reform of the interest rate benchmarks;

• full coverage by the banks of the required MREL recapitalisation amount with eligible debt instruments;

• a review of the Long-term Funding Ratio (WFD) to assess the advisability of its eventual implementation or modification;

• strengthening of the interest rate risk management system by cooperative banks and efforts to reverse the decline in the number of their shareholders;

• the inclusion of the risk arising from the high share of expected profits from future premiums in own funds and from double gearing in the assessment of the solvency of insurance companies;

• the inclusion of life annuity to the product range of insurance companies and a guarantee of adequate value for the customer in the insurance agreements;

• proper communication to the customers about the scope of insurance coverage provided and the amount of potential indemnity to be paid by the insurance company;

• a reduction in the maturity mismatch between assets and liabilities of open-ended investment funds.