Financial Stability Report. June 2024

The financial system is stable, and the banking sector, which constitutes its key component, remains resilient to shocks.

Thanks to high profits recently reported by banks and the issuances of debt instruments eligible for MREL, capital surpluses in the banking sector are high, which creates significant space for growth in lending and scope for absorption of potential losses.

The portfolio of FX housing loans continues to be the main source of burden for the banking sector. However, the scale of future costs of this risk should not pose a threat to the stable functioning of the banking sector.

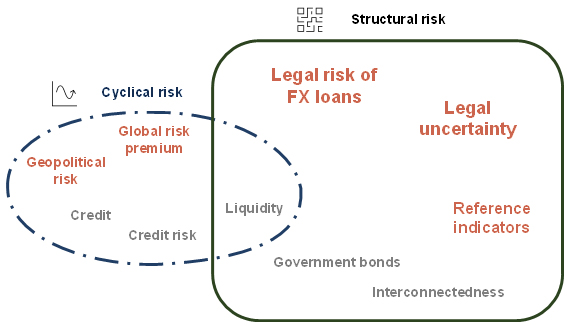

Variability and uncertainty concerning the legal and regulatory environment in which banks operate may affect banks’ willingness to finance the economy, as well as foreign investors’ perceptions of the attractiveness of the Polish market.

The implementation of the reform of interest rate benchmarks continues to be of crucial importance.

In the opinion of Narodowy Bank Polski, implementation of the following recommendations will be conducive to maintaining the stability of the domestic financial system.

1. Reduction of legal and regulatory risk

Both public institutions and private entities should take into account the appropriate balance of consumer protection.

Banks should approach the construction of contracts with consumers with particular care and inform them adequately about the offered products.

2. Reform of interest rate benchmarks

Efforts should be made to eliminate uncertainty about which benchmark will ultimately replace WIBOR.

3. Settlements in FX housing loans

Banks and borrowers should continue to reach settlements in FX housing loan cases, thus contributing to accelerating the pace of dispute resolution.

4. Compliance with the MREL with debt instruments

Banks should successively increase the share of eligible debt instruments in the MREL requirement in order to cover with them the entire amount earmarked for recapitalisation

5. Releasable macroprudential capital buffers

It is justified to implement a positive level of countercyclical buffer.

6. Increasing the effectiveness and resilience of the cooperative banking sector

The cooperative banks should take steps to increase the number of shareholders and activate cooperative members.

7. Adequate assessment of the solvency of insurance companies and the supply of insurance products hedging against longevity risk

When making their solvency assessments, insurance companies should consider the risk stemming from a high share of expected profits from future premiums (EPIFP) in own funds and double gearing of capital.

It is desirable to increase the supply of insurance products enabling hedging of longevity risk along the lines of other developed markets.

8. Seeking to reduce the mismatch between assets and liabilities in the investment fund sector

In view of the experience of recent years, open-ended investment funds should seek to develop good practice in reducing liquidity mismatch between assets and liabilities.