Press release of the Financial Stability Committee after its meeting on macroprudential supervision

The meeting of the Financial Stability Committee on 14 June 2024 was attended by:

- Artur Soboń, Member of the Management Board of Narodowy Bank Polski as the Chair of the Committee,

- Jurand Drop, Undersecretary of State at the Ministry of Finance,

- Marcin Mikołajczyk, Deputy Chairman of the Polish Financial Supervision Authority,

- Krzysztof Budzich, Member of the Management Board of the Bank Guarantee Fund.

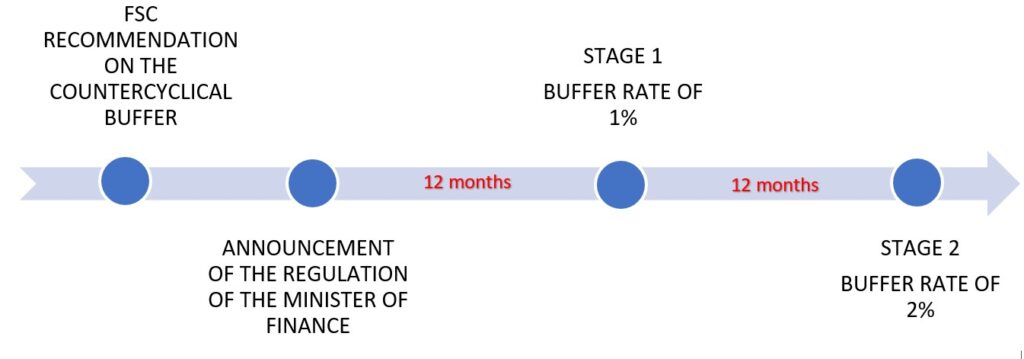

The Financial Stability Committee (FSC) passed a resolution on a recommendation on setting the countercyclical capital buffer rate at:

- 1% – after 12 months

- 2% – after 24 months

from the announcement of a regulation on the issue by the Minister of Finance.

The Minister of Finance accepted the recommendation and declared to take appropriate legislative actions.

The Committee’s recommendation is based on the Strategy on the application of the countercyclical capital buffer in Poland, the document adopted in March 2024. The Committee considered it advisable to set the positive neutral rate of the countercyclical capital buffer (nCCyB), which is prudential in nature, and will be binding for banks also at a standard risk level, i.e. for most of the financial cycle. This will help to strengthen the resilience of the banking sector and allow banks to prepare for potential crisis situations following the materialisation of the types of risk that are difficult to predict or are unforeseeable (such as a pandemic).

The Committee assumes the following schedule for the introduction of the nCCyB:

The quarterly systemic risk source assessment survey, conducted on a regular basis among institutions represented in the FSC, shows that the legal risk of FX housing loans and geopolitical risk remain the major sources of systemic risk. The Committee took note of the NBP Financial Stability Report. June 2024.

The Committee summarised the current trends on the domestic residential real estate market. A further increase in nominal and real housing prices has been observed recently. The available offer of dwellings has increased, and so has the number of issued building permits and implemented construction investments. Housing loan demand has dropped significantly compared to the previous quarter, although it has remained higher than in the corresponding period of 2023. The quality of the housing loan portfolio remains good and stable.

The Committee examined the draft amendment to the Recommendation of the Polish Financial Supervision Authority on the long-term financing ratio (WFD). The aim of this recommendation is to alter the structure of financing mortgage loans by increasing the use of long-term debt instruments in the process. The Committee presented its opinion on the draft and submitted to the PFSA’s consideration issues that, in the Committee’s view, should be the subject of further reflection prior to the issue of a final version of the recommendation.

The Committee adopted the Annual Report on Macroprudential Supervision Activity of the Financial Stability Committee 2023. The Committee’s Report fulfils the obligations indicated in the Act on Macroprudential Supervision and will be submitted to the Polish Sejm by the Governor of Narodowy Bank Polski – the Chair of the Financial Stability Committee, and posted on the NBP website.

Implementing the European Systemic Risk Board Recommendation (ESRB/2015/2) on the assessment of cross-border effects of and voluntary reciprocity for macroprudential policy measures, the Committee studied the results of :

- the monitoring of the Polish banking sector’s exposures to Norway,

- analyses on the Polish banking sector’s exposures to Portugal,

and in both cases, it concluded that there are reasons justifying non-reciprocity of the macroprudential measures implemented in these two countries.

Moreover, it decided to communicate to the ESRB information on the non-identification of relevant third countries for the purposes of recognizing and setting a countercyclical buffer rate.

The Committee took note of the review of macroprudential policy conducted at national level and in the European Union.

The next regular meeting of the Committee on macroprudential supervision has been scheduled for September 2024.