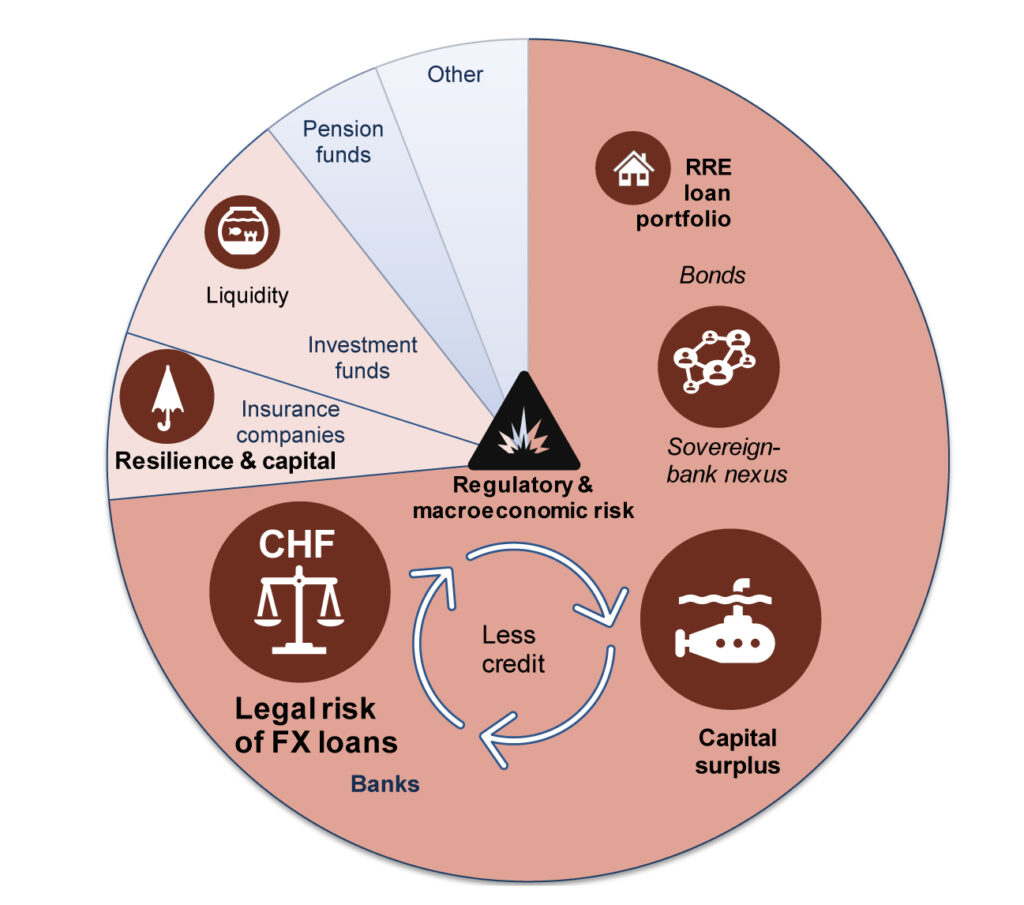

The financial system is stable, but the balance of risks is deteriorating

The level of banks’ capital is adequate to cover potential losses arising from the materialisation of even extreme macroeconomic scenarios. The banks also show high resilience to liquidity risk.

However, the balance of risks is deteriorating due to the likely fall in capital surpluses. This may occur, among others, if banks would comply with the MREL requirement with capital and not with eligible debt instruments. This would increase the risk of a credit crunch.

The uncertainty of the legal and regulatory environment and the costs related to these factors may adversely affect the ability and willingness of banks to finance the economy. A high interest rate environment supports growing bank profits; however, as happened in 2022, the final annual earnings of the banking sector will be under strong pressure of the costs of legal risk of FX housing loans and will also be dependent on the potential borrower support programmes.

In the opinion of Narodowy Bank Polski, the implementation of the recommendations listed below will support the maintenance of the stability of the domestic financial system.

1. Reduction of legal and regulatory risk

The uncertainty of the legal and regulatory environment in which banks operate should be reduced.

2. Support for borrowers

Statutory support for borrowers should be limited to financially distressed individuals.

3. Settlements in FX housing loan cases

Banks and borrowers should continue to reach settlements in FX housing loan cases, thus contributing to accelerating the pace of dispute resolution.

4. Compliance with the MREL with debt instruments

Banks should comply with MREL in a significant part with eligible debt instruments.

5. Retention of earnings by banks

Banks should consider retaining a significant part of earnings from 2023 and from previous years in order to safeguard internal sources of capital for lending expansion.

6. Increasing the effectiveness and resilience of the cooperative banking sector

It is necessary to further strengthen the effectiveness and resilience of the cooperative banking sector as well as continue the build-up of buffers which reduce the negative effects of any possible materialisation of risk in the future.

7. Taking into account conservative assumptions in the assessment of the solvency of insurance companies

When making solvency assessments, insurance companies should consider the risk arising from the high proportion of expected profits from future premiums and the double gearing of capital.

8. Seeking to reduce the mismatch between assets and liabilities in the investment fund sector

It is desirable that the liquidity profile of the assets matches the frequency of unit redemption. In addition, open-ended investment funds should not excessively increase leverage.