Financial Stability Report, June 2022

Domestic financial stability assessment has been improving systematically, however the uncertainty about the financial stability outlook is high.

Since the release of the last edition of the Report, the overall domestic financial stability assessment has improved further. The macroeconomic uncertainty arising, among others, from the war in Ukraine, and legal solutions on borrower support, will impinge on the banking sector outlook.

The substantial surpluses of accumulated capital in the banking sector and the expected improvement in profitability in an environment of higher interest rates results in high capacity to cover potential losses. However, the factor impacting the future earnings of banks will be the legal solutions on borrower support, which may significantly reduce capacity of banks to absorb shocks in the economy, and at the same time create a moral hazard and legal uncertainty for the future.

The legal risk of FX housing loans remains the main risk to financial stability in Poland – however, banks’ resilience to the risk has improved. This was helped by the fact that banks created substantial provisions and became more active in offering settlement proposals to borrowers.

Elevated macroeconomic uncertainty, tighter regulatory requirements and higher credit costs are factors responsible for bringing lending to a halt. However, no signs of a credit crunch are in sight.

Financial Stability Report, June 2022

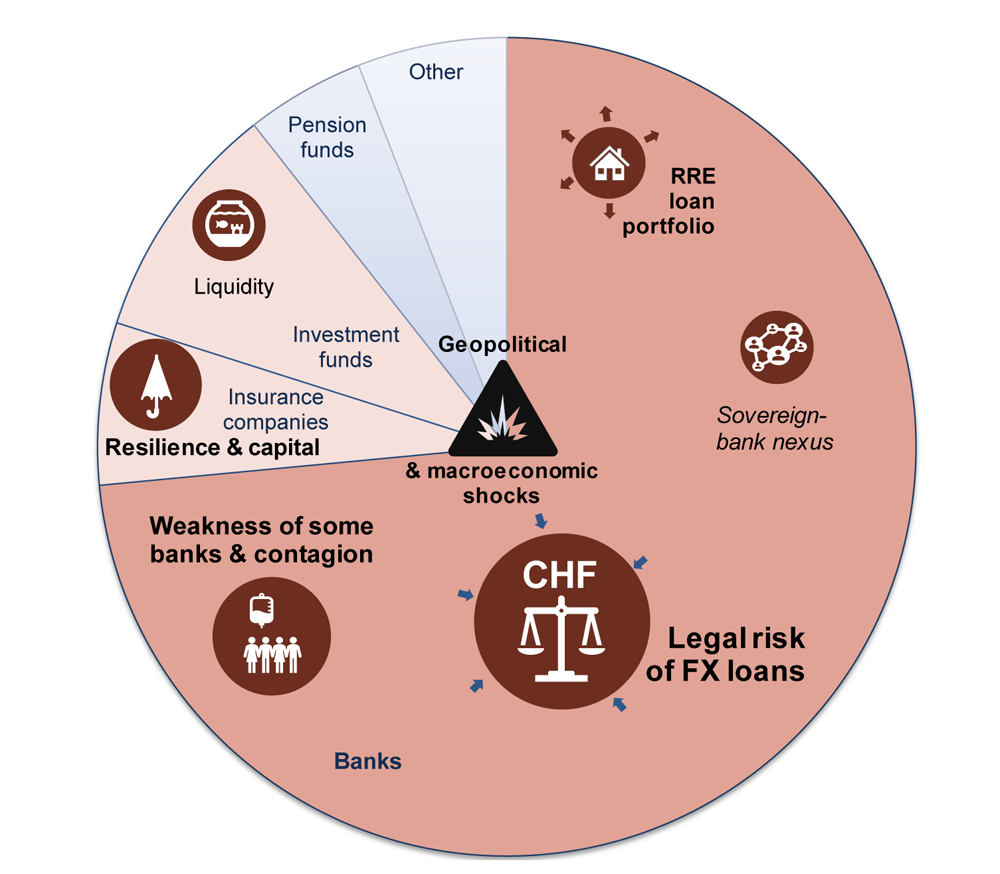

Notes: Shares of individual sectors (banks, insurance companies, etc.) reflect the value of their assets as at the end of 2020. The size of the circle describing the risk depends on the scale of risk (low, average, high). The main interactions – amplifications – across the risk are marked with grey arrows. Blue arrows pointing inwards towards the type of risk denote a decrease in risk, while red arrows pointing outwards from the type of risk denote an increase in risk. A new risk is marked with a black arrow that goes from outside the circle. The colour of individual sectors shows systemic risk intensity – from very low risk (blue colour), through low and moderate to high (burgundy).

According to the opinion of Narodowy Bank Polski, the implementation of the following recommendations will be conducive to maintaining the stability of the domestic financial system.

- Banks and borrowers should keep seeking to settle their disputes out of court and reach settlements in FX housing loan cases. Settlements should be entered into on the terms and conditions agreed by the borrower and the lender.

- It is justified to consider applying a non-zero level of releasable capital buffers. The experience of recent years has shown that certain unforeseeable events may be of significance for financial stability and releasable capital buffers would help better absorb such shocks in the financial system.

- Measures aimed at protecting or supporting specific groups of consumers of financial services should be so designed as to prevent negative effects for financial stability and, consequently, for other consumers and financial market participants.

- It is advisable to continue the consolidation process in the cooperative banking sector.

- When making their solvency assessments, insurance companies should factor in the risk of double gearing of capital and the high share of expected profits included in future premiums in own funds.

- Investment funds that redeem participation units upon request should reduce the scale of liquidity transformation implemented and increase their liquid asset buffers.