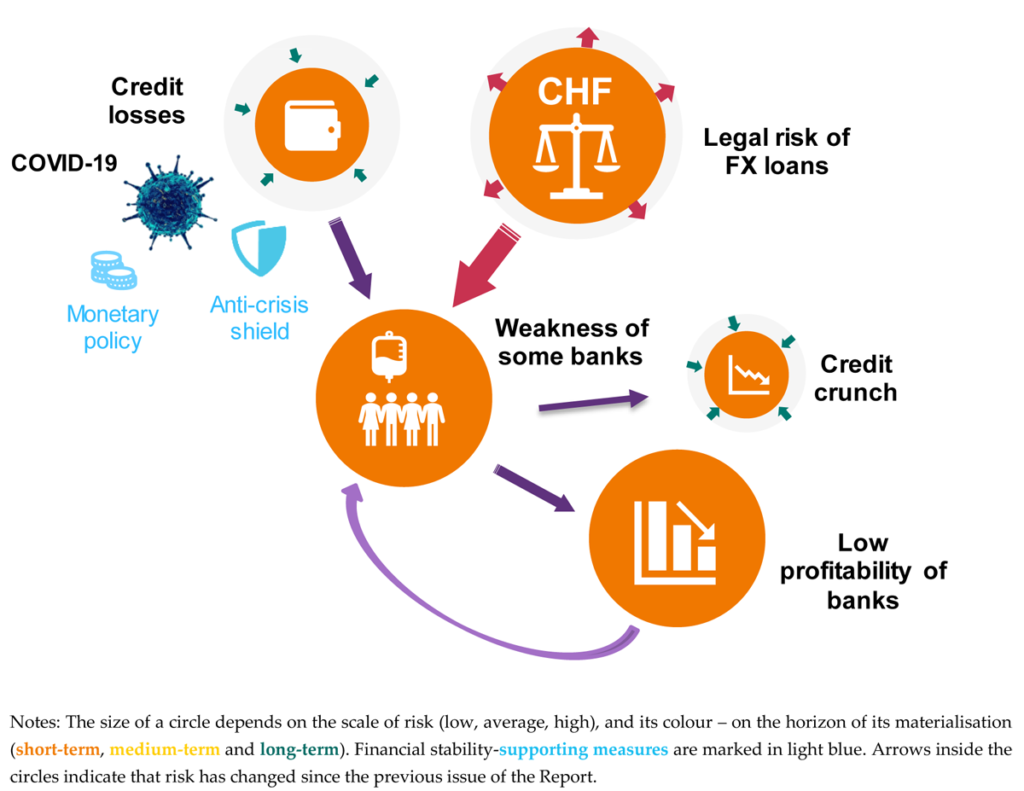

Legal risk of the FX mortgage loan portfolio is a major threat to financial stability

The uncertainty concerning the cost related to the FX loan portfolio is high and materialization of certain scenarios may jeopardize the stability of the entire financial system. The magnitude of costs will be partly determined by the anticipated ruling of the Civil Chamber of the Supreme Court of the Republic of Poland.

The COVID-19 pandemic fallout, despite its substantial impact on the real economy and expected future credit losses, does not put Poland’s banking sector at risk. At the same time, a significant slowdown in credit dynamics notwithstanding, there are no signs of a credit crunch. The expected improvement in Poland’s economic situation should be conducive to restoring the demand for credit.

A decrease in the profitability of the banking sector, already observed prior to the COVID-19 outbreak, has deepened considerably and constiututes a challenge. It reduces the banking sector’s capacity to strengthen its capital base and weakens its resilience.

In the opinion of Narodowy Bank Polski, the implementation of the following recommendations will be conducive to maintaining the stability of the domestic financial system.

- Banks should maintain a conservative capital policy until the full impact of the COVID-19 pandemic and the decisions of the Supreme Court of the Republic of Poland concerning FX loans has been identified.

- Banks and borrowers should seek to settle disputes and reach settlement concerning FX housing loans out of court.

- The situation of certain credit institutions requires self-remedial actions, especially ones ensuring a reliable and quick improvement of their capital position.

- Banks should continue to pursue a prudent lendning policy with respect to real estate.

- Following the cessation of most of LIBOR benchmarks at the end of 2021, domestic financial institutions, especially banks, should immediately review the contracts where these benchmarks are used as reference rates.

- Investment fund management companies should strengthen the resilience of the invest-ment funds they manage by increasing their liquidity buffers.

- When assessing their resilience to shocks and related capital needs, insurance companies should factor in the consequences of double gearing of capital and the high share of expected profits included in future premiums in own funds.

- Life insurance companies should restrain from offering unit-linked insurance for which the protective component has been reduced.